Do you want the best tax accountant in Perth?

Are you looking for someone who understands your business?

Choosing the best tax accountant isn’t just about finding someone to lodge your BAS or end-of-year return.

It’s about finding an accountant who can help you:

- Legally minimise your tax

- Improve your cash flow and profitability

- Find opportunities for growth

- Give you clarity and confidence in your finances

If you get it wrong, you could be overpaying on tax, missing deductions, and struggling to keep up with ATO changes.

If you get it right, you’ll have a proactive ally who understands your business, your industry, and your business goals.

That’s why we’ve created a guide to help you choose the best tax accountant in Perth.

We’ll walk you through

- How to choose the right accountant for your small business

- The key qualities to look for in a Perth-based accountant

- Questions to ask before hiring an accountant

- Common mistakes to avoid when hiring an accountant

- Signs you’ve outgrown your current accountant

- How accountants add value far beyond tax returns and BAS lodgements

- How to decide who the best tax accountant in Perth is for your business

Why Choosing the Right Accountant Matters

For a lot of small business owners, an accountant is just “the tax person”.

It’s someone you see once a year to lodge your tax return. That’s like using a Swiss army knife just to open a bottle of wine. You’re ignoring everything else it can do.

The best accountants in Perth aren’t just number crunchers (or tax preparers). They’re business advisors too.

It’s important to look for someone who can not only help you with taxes, but also help you:

- Set up tax-effective business structures (companies, trusts, or sole traders)

- Set up industry software for your business that automatically tracks debtors and creditors, invoicing, or ecommerce integrations

- Understand your financial position and how to make your business more profitable, identifying your most profitable services or products.

- Make better, faster decisions to grow your business and expand your customer base (or add a new business location).

And they can do it all year round, on a monthly or quarterly basis.

How to Find the Best Tax Accountant in Perth

Choosing an accountant isn’t like buying a stapler — you can’t just grab one off the shelf and expect it to work the same for everyone.

This is about finding someone who fits your business (and ideally knows your industry inside out).

1. Ask Other Business Owners & Talk to people in your industry.

A tradie in Fremantle will have different needs than a doctor in Subiaco, but both will know if their accountant is responsive, proactive, and easy to work with. Ask them:

- Do they explain things in plain English?

- Do they specialise in a particular industry?

- Do they call you with ideas, or only when you owe the ATO?

- How quickly do they reply to emails?

- Do they offer services like bookkeeping, virtual CFO, superannuation, or cloud accounting to help grow your business?

2. Check Google Reviews

Customer reviews give you an unfiltered look at how accountants treat their clients. Look for recurring praise about:

- Speed of response

- Knowledge of specific industries

- Ability to solve problems

Note: Watch out for Perth accountants who have a perfect 5-star rating on Google Maps. This could be an indication of paid reviews (it’s more common than you think!).

3. Look at Their Industry Experience

A Perth accountant who works with tradies will understand the complexities of subcontractors, invoicing delays, TPAR reporting, and GST on materials.

A healthcare-focused accountant who works with doctors and dentists will know about Medicare, private health billings, GST, and equipment depreciation.

These nuances matter if you’re serious about reducing your taxes and protecting your business from ATO problems down the track.

4. Meet Them First

Book a short meeting before hiring a Perth accountant— either online or face-to-face.

See if they listen to your concerns, explain things clearly, and ask smart questions about your business. If they talk over you or go straight into jargon (or just focus on tax), it’s time to look elsewhere.

It’s important to get it right so that you don’t end up changing accountants every year. You want someone who can partner with you for years to come. Someone who will grow with your business (not hold you back).

What to Look For in a Perth Accountant

Here’s how you separate a good accountant from a great one:

1. Transparent Fees

No one likes surprise invoices. The best accountants will offer a clear pricing structure — whether that’s a fixed monthly fee or hourly rates. You should know exactly what’s included (and what’s not).

2. Cloud Accounting Expertise

If they’re not fluent in Xero (ideally a Xero Gold Champion Partner), they’re behind the times. Cloud accounting saves hours, reduces errors, and gives you real-time access to your numbers from anywhere.

3. Proactive Advice

You don’t just want someone who answers your questions. You want someone who’s scanning your financial data for opportunities.

Maybe it’s a tax planning move before 30 June, or maybe it’s spotting a decrease in profit margins before it hurts.

Or maybe it’s identifying cash flow problems that are affecting your bank balance.

4. Knowledge & Skillset

Are they a registered tax agent or CA member? Do they have a passion for accounting and are they regularly learning about accounting and business?

Look for a Perth accountant who loves upskilling so that they’re growing with you.

5. Accessibility

When you have a question, you want an answer — fast. If your accountant takes days to respond, it slows down your business. The best firms reply quickly, even if it’s just to say, “Got your message, working on it.”

Questions to Ask Your Accountant Before You Hire Them

You wouldn’t hire a staff member without asking a few questions. The same goes for your accountant.

1. How will you help me pay less tax legally?

A good accountant should offer tax planning services and give examples of strategies they’ve used — not vague promises. Make sure they’re reputable and not giving you dodgy tax advice (trust your gut).

A great accountant will help you adjust your business structure as needed, highlight industry-specific deductions, and help with timing asset purchases strategically.

2. Do you provide year-round advice, or just end-of-year compliance?

If they only show up at tax time, you’re missing out. Year-round advice means ongoing tax planning, cash flow monitoring, bookkeeping, and quick solutions when problems pop up.

Look for someone who will be across all aspects of your business and who takes initiative.

3. Can you help with cash flow forecasting and budgeting?

Many profitable Perth businesses still fail because of poor cash flow. A forward-looking accountant will track your inflows and outflows, predict seasonal dips, and help you prepare in advance.

4. How do you stay on top of changing tax laws?

The tax landscape shifts constantly. The best accountants regularly update their knowledge — through training, ATO updates, and professional networks — so their advice stays relevant.

5. What’s your average response time for client queries?

If you send an urgent question, you need to know they won’t take a week to get back to you. Quick communication keeps your business moving.

Common Mistakes People Make When Choosing Their Tax Accountant

Even smart business owners get tripped up when picking an accountant. Here are the big traps:

1. Choosing Based on Price Alone

It’s tempting to go with the cheapest quote, especially when margins are tight. But a low-cost accountant who only does the bare minimum can end up costing you more in missed deductions, poor advice, and ATO penalties.

2. Ignoring Industry Experience

Every industry has its quirks. By choosing an accountant that knows your industry, you’ll get access to specific tax advice and business strategies relevant to your business. A generalist may miss these nuances.

3. Accepting Slow Communication

If your accountant takes a week to reply to urgent questions, that delay can stall important decisions — like whether to buy new equipment or how to handle a sudden cash shortfall.

Signs You’ve Outgrown Your Current Accountant

Sometimes it’s not about hiring a new accountant, it’s about replacing one who’s holding your business back. You may have outgrown your accountant if:

1. They’re Only Reactive

If you only hear from them when you owe money, need to lodge a BAS, or need to sign something, you’re missing opportunities for business growth advice.

2. You’re Doing the Work They Should Be Doing

If you’re handling more and more of your own bookkeeping or chasing overdue invoices because they haven’t set up systems, it’s a sign they’re not adding value.

3. They Can’t Keep Up With Your Growth

A sole trader with five clients is very different from a growing company with staff and complex contracts. If your accountant isn’t able to match your business needs, you’ll feel it in errors and admin bottlenecks.

4. You’re Not Learning Anything New

The best accountants educate you on your numbers and how your business is performing. They look beyond your tax situation.

If you feel like you’re in the dark, or confused after meetings — it might be time to move on. Find an accountant who can help you understand your financial data and make smarter business decisions.

How Accountants Save You Money Beyond Tax

Tax returns and BAS lodgements are both small parts of what a great accountant can do. But there’s so much more they have to offer!

Here’s how the best accountants in Perth help businesses keep more money in their pocket:

Improving Efficiency

Accountants can spot areas where you’re overspending — like paying for unused software subscriptions or carrying excess stock. Reducing these expenses can improve your bottom line without increasing sales.

Optimising Pricing

We can help analyse your margins and adjust prices strategically. This is especially important for businesses with fluctuating supplier costs.

Debt Management

Good accountants can restructure your loans to reduce interest payments, consolidate debts, or identify when it’s better to pay off debt vs reinvest in your business. They can also assist with debt recycling (tax-deductible debt).

Better Financing Deals

With accurate, up-to-date financial reports, you can present a strong case to lenders and negotiate better loan terms.

Cash Flow Control

By forecasting incoming and outgoing cash, a good business accountant can help you avoid shortfalls that force you into expensive short-term financing.

Exit Strategies

If you’re looking to sell your business or form a succession plan, a good accountant can help with maximising your business value prior to the sale or handover. They can also help with minimising your taxes in situations like this.

These are some of the things included in our virtual CFO services.

The Best Tax Accountants in Perth

Here’s Our List of the Top 10 Tax Accountants in Perth – 2025 Edition

To put this list together, we looked at more than just a business name or location. Our selection was based on:

- Google reviews – average rating and number of reviews.

- Service offering – range and depth of accounting, tax, and advisory services.

- Website quality – clarity, professionalism, and how well they present their services.

- Customer feedback – what clients are saying online and in testimonials

- Industry specialisations – experience with trades, medical practices, and other key sectors.

This way, you can be confident the firms listed here aren’t just good on paper — they have the skills, results, and reputation to back it up.

Best Tax Accountants in Perth

- Evolve Accountants & Business Advisors – Overall Best – Subiaco

- Nexus Tax and Accounting – Wangara

- Pine Tax Accounting Perth – West Perth

- DPS Accounting – Perth CBD

- Universal Taxation Services – Cannington

- The Tax Lab – Balcatta

- Balance Tax Accounting – Gwelup

- SALM Group Accounting – Subiaco

- Fortune Accounting and Taxation – Dayton

- ABS Tax – Osborne Park

1. Evolve Accountants & Business Advisors – Overall Best Tax Accountant in Perth

For over 28 years, Evolve Accountants & Business Advisors has been helping Perth businesses get control over their numbers, reduce tax, and grow sustainably.

If you’re looking for a tax accountant who doesn’t just turn up at EOFY (but helps you all year-round), our team should be your first call.

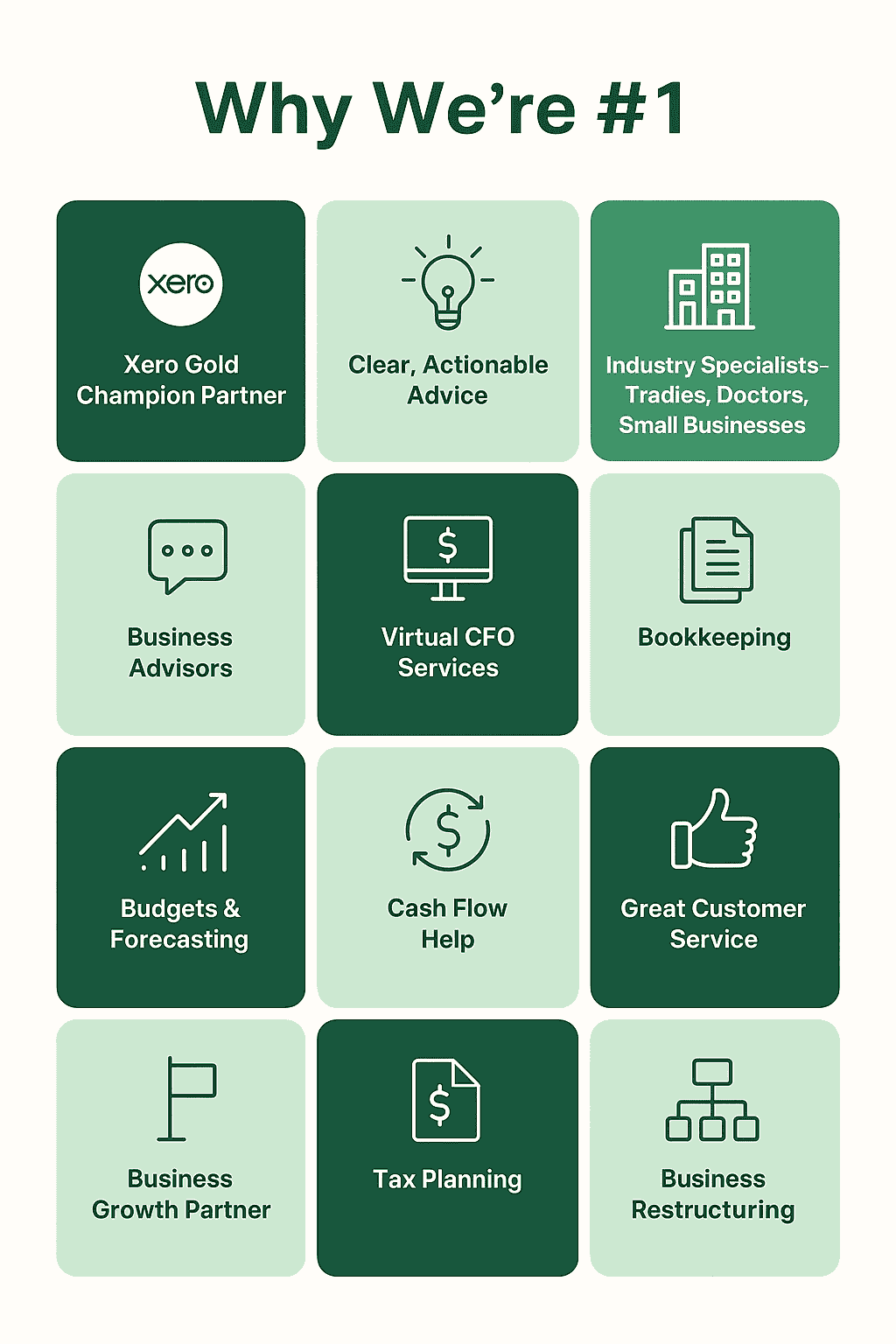

Here’s why Evolve Accountants ranks #1 in Perth:

1. Xero Gold Champion Partner – We’re specialists in cloud accounting, giving you faster, more accurate numbers and real-time access to your information.

2. Flexible billing – You can choose between fixed fees or hourly rates.

3. Down-to-earth and approachable – No tax jargon, just clear, simple explanations with practical advice you can take action on straightaway.

4. Industry specialisation – We have extensive experience working with trades (plumbers, electricians, builders, construction), medical practices (GPs, doctors, dentists, and other health practitioners), and other small businesses in the Perth region.

5. Long-term clients: Most of our clients have been with us for over 10 years – we take pride in our client relationships.

6. Full-service offering – We provide a complete, top-tier accounting service for your business including: Tax & Compliance Services, Virtual CFO, Bookkeeping, Superannuation, Cloud Accounting, andCorporate Secretarial Services.

7. Cash flow mastery – We can help you track, forecast, and improve your cash flow with software so that you keep your finger on the pulse at all times.

8. Budgeting & forecasting – We can prepare practical financial budgets and forecasts that align with your business goals.

9. Affordable – We offer fair pricing with no surprises. We won’t bill you for anything you don’t need.

10. Super responsive – We provide quick, short replies, even outside of our standard business hours when needed (e.g. for urgent matters).

Evolve Accountants & Business Advisors is best for tradies, doctors, and small businesses who want proactive, year-round advice — not just an annual tax return.

To find out more about our services and working together, you can contact us here.

Who We’re Not the Right Fit For

While we work with a wide range of Perth small businesses, our expertise is best suited to certain industries and business sizes.

We’re probably not the right accountant for you if:

You’re an individual taxpayer only — We specialise in business clients, not personal tax returns for employees.

You run a very large corporate or major construction company — We focus on small to medium enterprises, not multi-tier corporate structures with complex, multinational reporting requirements.

You’re in a highly technical, niche industry requiring specialist compliance — such as mining exploration compliance, large-scale manufacturing, or complex import/export tariff consulting.

You’re a high-volume ecommerce business with complex international logistics — We’re not specialists in overseas tax jurisdictions, marketplaces like Amazon, or cross-border sales compliance.

You want a once-a-year, bare-minimum service — We work best with clients who want regular, proactive advice and year-round support to grow their business.

You’re looking for the absolute cheapest option — We focus on value and results, not being the lowest price in the market.

What makes us different is our approach — we’re not just reporting on the past, we’re helping you build the future you want.

2. Nexus Tax and Accounting

Based in Wangara, Nexus is a tax agency specialising in personal and small business tax returns, sole traders, and larger companies. They focus on compliance, tax planning, and restructuring for local businesses.

3. Pine Tax Accounting Perth

Pine Tax Accounting are CPAs based in West Perth. They provide efficient and cost-effective accounting and tax services, including tax returns for individuals, sole traders, partnerships, company, trusts, and SMSF’s.

4. DPS Accounting

Based in the Perth CBD, DPS Accounting provides tax services for a range of businesses and SMSFs. They also provide bookkeeping and payroll services. They’re a Xero platinum partner.

5. Universal Taxation Services

Universal Taxation Services is based in Cannington. They have 15+ years’ experience across Perth, helping individuals and businesses with tax returns, BAS, bookkeeping, payroll, business registrations, and more. They focus on providing clear advice and helping their clients grow.

6. The Tax Lab

The Tax Lab is based in Balcatta. They specialise in tax returns for companies, sole traders, and partnerships, while offering BAS and IAS, bookkeeping, business registrations, and business plans. They don’t specialise in a particular industry.

7. Balance Tax Accounting

Based in Gwelup, Balance Tax is led by Anthony Campbell. They specialise in personal and business tax returns, property-focused tax strategies, and self-managed super funds. They also offer flexible appointments after-hours.

8. SALM Group Accounting

SALM Group Accounting, based in Subiaco, provides tax and compliance services for individuals and businesses. They also provide bookkeeping for small and medium sized businesses across Australia. Their specialties are small business accounting and individual tax returns, especially negative gearing and capital gains.

9. Fortune Accounting and Taxation

Fortune Accounting provides tax return services, BAS lodgements, financial statements and ATO assistance. They also provide bookkeeping and payroll services. They specialise in helping financial traders and hospitality businesses.

10. ABS Tax

ABS Tax & Home Loans serves Perth and Australia-wide businesses. They specialise in bookkeeping, loans, and cloud accounting. They work with small and medium sized businesses. ABS Tax is a tech-focused tax firm and can help you with mortgage and insurance services.

Why Is Evolve Accountants & Business Advisors the Best Tax Accountant in Perth?

While most accounting firms are skilled in tax compliance, that’s only one part of what a good accountant can do. Our team focuses on the future as well as the past — with business advisory, cash flow management, budgeting, bookkeeping, superannuation, and virtual CFO services to help your business grow sustainably into the future.

We look at your business holistically, not just from a tax perspective.

You can contact us here to find out more.

FAQs – Finding a Perth Accountant

1. Who is the best tax accountant in Perth?

The best Perth accountant is someone who understands your business, provides actionable advice, and aligns with your specific industry. See our 5-star Google reviews here.

2. How much does a Perth accountant cost?

Accounting fees can vary based on the type of service, quality, and structure. We offer both fixed-fee and hourly billing. Get a quote here.

3. Do I need a local Perth accountant?

If you run a Perth-based business, it’s worth hiring a Perth accountant. A local accountant understands WA rules, industry trends, and the Perth business landscape. Our Perth office is located here.

4. Can a tax accountant help with cash flow?

Not all tax accountants can help with cashflow. Most tax accountants focus on ATO compliance, BAS, and tax which is important, but it’s also important to look at your overall business health. We provide forecasting, budgeting, and management strategies to help your business grow and become more profitable.

5. Do you work with all types of small businesses?

Yes — we work with tradies, doctors, dentists, retail businesses, hospitality, allied healthcare, small businesses, and more. If you want to find out more about working together (or check if we know your specific industry), you can contact us here.

Disclaimer: This information is intended to be a guide only. Evolve Accountants & Business Advisors and its directors, employees and consultants expressly disclaim any and all liability to any person, whether a purchaser or not, for the consequences of anything done or omitted to be done by any such person relying on a part or the whole of the contents on this website. Do not act on the information without first obtaining specific advice regarding your particular circumstances from a tax professional. All content provided is for general information purposes only.

About The Author

Russell Pelusey

Russell Pelusey is a Chartered Accountant and business advisor with 28 years of experience. He specialises in tax planning and CFO services for small and medium sized businesses. He’s a Xero Gold Partner and registered tax agent based in Perth, Australia.